49 Crypto Stats, Facts, and Trends

Did you know that more than 19,000 different cryptocurrencies exist today? Cryptocurrencies are a hot topic and an investment opportunity, but it can be hard to keep track of all the options and understand what makes each unique.

In this blog post, we’ll take a look at some remarkable crypto stats, facts, and trends. You’ll learn about the booming cryptocurrency market and get a better understanding of how these digital currencies work. So dive in and get started!

Key Cryptocurrency Statistics

- The cryptocurrency market cap reached $3 trillion in 2021.

- The bear market and financial crisis of 2022 have reduced the crypto market to as low as $800 billion.

- There are more than 19,000 different cryptocurrencies in circulation.

- The top 5 cryptos make up 75% of the market.

- Bitcoin was launched in 2009.

- BTC rose in value by 17,300% in the last nine years.

- The US has the most Bitcoin ATMs.

- Just five BTC addresses have more than 100,000 BTC.

- Ethereum reduced its energy consumption by 99.95%.

- Around 20% of the Vietnamese own crypto.

- Over 46 million Americans are crypto investors.

- More than 80% of US residents have heard about cryptocurrencies.

- Men are twice as likely to invest in digital currencies than women.

- El Salvador was the first to adopt BTC as a legal tender.

- Lack of knowledge is keeping investors away.

- Crypto-betting more than doubled in 2022.

- Almost three-quarters of US investors own BTC.

- Gamblers prefer to use BTC, ETH, and LTC as their crypto of choice.

Facts About the Cryptocurrency Market

The growth of the cryptocurrency industry from the early days of Bitcoin to today’s booming market is nothing short of amazing. Here are just some key facts showing how the state of the crypto industry has changed and grown to this size.

1. The all-time crypto market high was around $3 trillion in November 2021.

(Live Coin Watch)

The crypto market has its share of ups and downs. The first major peak was in January 2018, when the market reached an $800 billion market cap for the first time. Another record-breaking crypto stat was also in May 2021, when the market cap reached $2.5 trillion, only to surpass it again later in the year.

2. In 2022, the cryptocurrency market cap dropped significantly, as low as $800 billion.

(Live Coin Watch)

While the record low didn’t hold for long, the whole industry has been hit hard by inflation and reacted similarly to stock markets.

3. The highest daily trade volume was on May 19, 2021, when more than $500 billion worth of cryptocurrencies were traded.

(Statista)

While this stat may indicate how many people use cryptocurrency on a daily basis, the spike in trading occurred despite rising skepticism about Dogecoin and a few weeks before China enacted its ban on crypto.

4. There are more than 19,000 cryptocurrencies in 2022.

(Live Coin Watch)

Since 2009, when Bitcoin emerged for the first time, the industry has been quick to follow up and give its own take on how it could contribute. While many projects don’t end up nearly as successful as Bitcoin or Ethereum, this doesn’t deter others from trying to get their own piece of the pie.

5. The top 10 cryptocurrencies by market cap make up more than 80% of the total crypto market.

(Live Coin Watch)

For top cryptocurrencies, statistics show how they have an impressive impact on the whole market. Bitcoin’s dominance is hard to shift as it alone makes up around 39% of the whole crypto market. The closest cryptocurrency to Bitcoin is Ether, with 19% of the market value. Furthermore, the top five cryptocurrencies, which include BTC, ETH, USDT, USDC, and BNB, represent 74% of the total market cap.

6. There are more than 5.85 million crypto transactions per day for the top 5 cryptocurrencies.

(Messari, Ycharts)

Keep in mind that the Ethereum network actually processes other transactions from ERC20 tokens and not just those with ETH. Furthermore, Bitcoin payments are made on the Bitcoin network and the Lightning Network, which are also not included in the figure above. Binance Smart Chain Transactions processes an impressive 3.25 million transactions per day.

Important Bitcoin Statistics and Facts

Bitcoin has been the driving force of the industry, and many projects claimed that they would dethrone it. Since its inception, BTC has remained the most dominant cryptocurrency and has always been one of the top investment recommendations.

7. The cryptocurrency that launched the whole industry in 2009 was Bitcoin.

(Time)

The cryptocurrency was created by Satoshi Nakamoto, an anonymous person or group of people. Bitcoin was the first decentralized cryptocurrency that used blockchain technology.

8. The smallest unit of measurement for a Bitcoin is called a satoshi.

(River Financial)

Like the US dollar is divided into cents and the British pound is divided into pennies, Bitcoin is divided into satoshis. Unlike one cent, which is a hundredth part of a dollar, a satoshi is much smaller. One BTC consists of 100 million satoshis.

9. Bitcoin’s all-time high value was more than $68,000.

(Live Coin Watch)

While the all-time high for BTC was in November 2021, the digital currency made substantial losses throughout 2022, and it’s now at $22,500. The Bitcoin and crypto statistics show that the industry has been hit hard by the fears of recession, rise in interest rates, and high inflation, just like the stock market.

10. The value of Bitcoin rose by 17,300% from September 2013 to September 2022.

(Coin Dance)

Bitcoin has been one of the best-performing assets in the last 10 years. It went from being worth almost nothing in 2010 to an all-time high in 2021, and even with significant losses, it still has a market cap of over $400 billion.

11. Bitcoin’s supply is limited to 21 million coins.

(CoinMarketCap, River Financial)

Currently, there are less than 19.15 million coins in circulation. It’s estimated that around 4 million BTC are permanently lost as users have either lost access to their wallets or haven’t passed private keys to their heirs.

12. Around 250,000 Bitcoin transactions are confirmed daily in 2022.

(Blockchain.com, Live Coin Watch)

Anywhere between 80,000 and 200,000 BTC are traded daily, and the average 24-hour volume in September 2022 was around $30 billion. Among the most impressive crypto stats is the daily volume Bitcoin saw on May 19, 2021, at $90 billion.

13. Bitcoin Pizza Day commemorates the first real-world transaction.

(CoinDesk)

On May 22, 2010, Laszlo Hanyecz paid another user of the bitcointalk.org forum 10,000 BTC for two Papa John’s pizzas. At Bitcoin’s all-time high price, those two pizzas would cost more than $680 million, but in 2010 they were around $40.

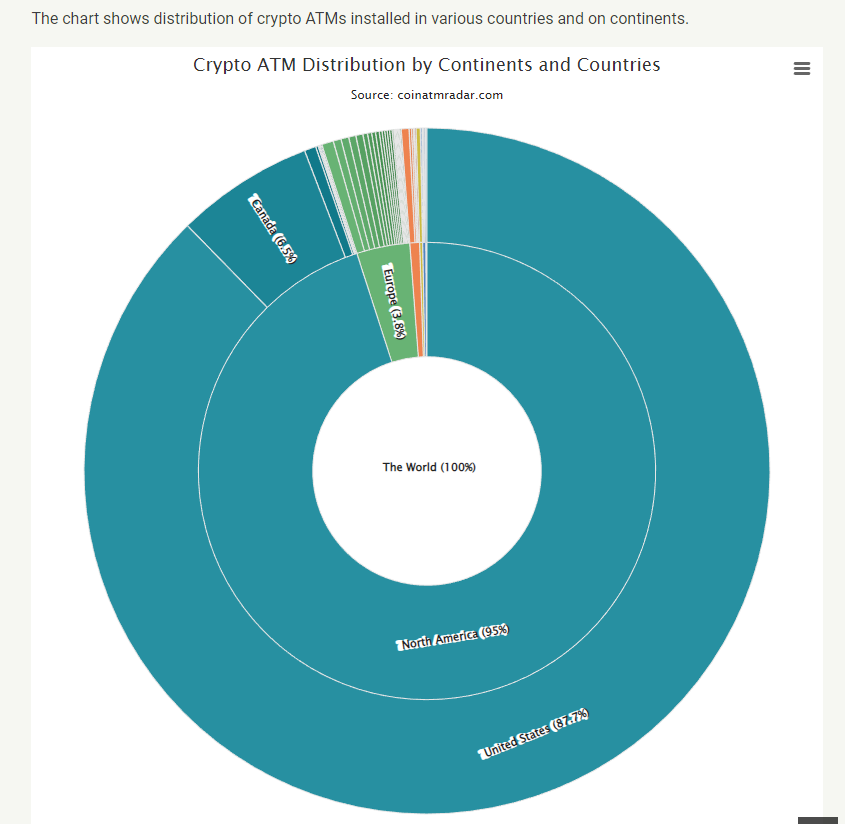

14. The US has the most Bitcoin ATMs in the world.

(Coin ATM Radar)

There are currently around 34,000 operational BTC ATMs in the US, followed by 2,600 in Canada and 257 in Spain. North America has the highest concentration of these ATMs as they make up 95% of the total number in the world.

15. Only 5 Bitcoin wallets have more than 100,000 BTC.

(BitInfoCharts)

The estimated number of Bitcoin users doesn’t directly correspond to the number of wallets in use since there can be multiple addresses per user. However, it’s interesting that around 100 addresses out of 43 million overall hold just under 20% of all BTC.

Four of the top five addresses are owned by cryptocurrency exchanges; three by Binance and one by Bitfinex. As these are some of the largest cryptocurrency exchanges, these are actually assets from their users held in reserve or in cold wallets.

16. The last Bitcoin will be mined in 2140.

(CoinDesk)

The number of bitcoins that are distributed among miners as a reward diminishes every four years. This is the so-called Bitcoin halving.

Currently, the reward for one block of verified transactions is 6.25 BTC. In 2024, it will be 3.125 BTC until, at one point, there are no new coins to distribute to Bitcoin miners, and transaction fees will be the only revenue stream for them.

Cryptocurrency Facts and Figures – Ethereum and Other Projects

The value of the cryptocurrency market and the significance of Bitcoin are hard to dispute. However, there are other interesting factors, such as the industry’s long-term feasibility and energy consumption and what kind of innovative new projects are brought in.

17. ICOs raised more than $12.5 billion in 2018.

(Statista)

Initial coin offerings (ICOs) were highly popular in 2017 and 2018 and have seen a significant influx of capital. In those two years, around $19.1 billion was raised.

The most profitable quarter was Q1 2018, with $6.88 billion. However, increased regulatory pressure has reduced the number of illegitimate projects; therefore, only $168 million of ICO investments were made in 2019.

18. Ether is the second most popular cryptocurrency.

(Live Coin Watch)

Unlike Bitcoin, which is used primarily as a currency and a store of value, Ethereum is an online platform for developing decentralized applications and organizations. It also provides a foundation on which other crypto tokens and projects are built.

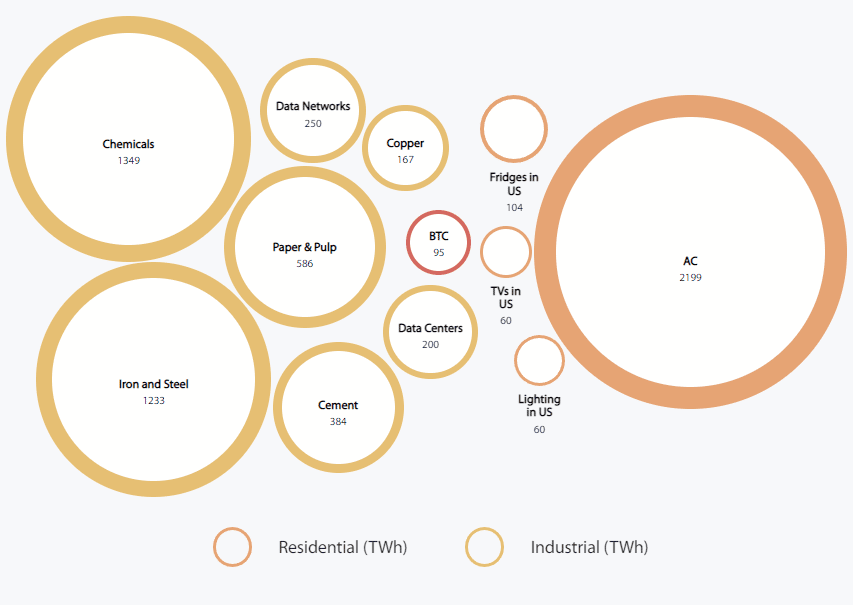

19. Ether and Bitcoin mining has an energy consumption of 112 TWh/year and 96.16 TWh/year, respectively.

(Ethereum, Cambridge Bitcoin Electricity Consumption Index)

Power consumption is one of the most frequently mentioned and interesting facts about the cryptocurrency industry. It’s often mentioned how Bitcoin consumes more electricity than some countries, but those figures miss how much other industries spend.

For instance, gold mining spends more than 131 TWh per year. Heavier industries spend even more, such as iron and steel (1,233 TWh per year) and chemicals (1,349 TWh per year). Global production of cement has a four-time higher energy demand at 384 TWh per year.

Still, such comparisons often aren’t as useful as they can seem minuscule or wasteful when compared with specific industries or countries. Some spend more energy than others because of their industry, weather conditions, or other factors.

20. Ethereum reduced its energy consumption by 99.95%.

(Ethereum)

The number of cryptocurrency users and the increasing demand for computer hardware needed to verify transactions have influenced certain cryptocurrency projects to change their approach to network security.

The commonly used consensus algorithm (the method of how crypto miners verify transactions) is proof of work (PoW), which requires a lot of electricity. Unlike Bitcoin, Ethereum shifted away from such a method of verifying transactions.

Ethereum implemented the proof of stake (PoS), a power-efficient method of verifying transactions. For example, mining Bitcoin requires specialized computer hardware, while to earn ETH, you will need to stake some of your Ether to become a validator.

21. Ethereum validators verify around 1.2 million transactions per day.

(YCharts)

With so many cryptocurrency transactions per day, the Ethereum network significantly decreased its greenhouse effect on the environment by implementing proof-of-stake.

22. The supply of new Ether tokens will drop from 14,600 to 1,600 ETH per day.

(Ethereum)

Crypto mining and staking rewards were two methods of creating new ETH tokens prior to the Ethereum 2.0 upgrade. Cryptocurrency mining statistics show that around 13,000 ETH per day was mined, and 1,600 ETH per day was earned through staking before the PoS shift. Now, only 1,600 ETH per day will be issued, reducing the issuance of new tokens by approximately 90%.

23. Ethereum will have a stable supply of tokens.

(Ethereum)

The Ethereum Improvement Proposal (EIP) 1559 is an upgrade launched on the network which introduces a way of reducing the number of ETH tokens in circulation by permanently destroying a portion of the transaction fee.

It’s estimated that the number of destroyed ETH tokens daily will match those created through staking rewards. Therefore, the supply will vary slightly based on how high the transaction fees are.

24. Staking 32 ETH is needed to become a validator on the Ethereum network.

(Glassnode)

While the average crypto holdings of Ethereum investors aren’t sufficient to run an independent validator node, there are ways of making more modest amounts of ETH work for you. Through Ether staking pools, many smaller ETH investors can collaborate and participate in the validation process without needing to have 32 ETH.

25. Bitcoin Cash (BCH) was created when the Bitcoin community couldn’t agree on the development course of the cryptocurrency.

(Cointelegraph)

Disagreement on how to solve Bitcoin’s transaction speed issues was the reason behind the creation of BCH. In the summer of 2017, Bitcoin underwent a hard fork that created BCH.

The main difference between BTC and BCH is the block size. While BTC has a block size limit of 1 MB, BCH has an 8 MB block size limit, which allows it to process more transactions per second.

26. Bitcoin Cash is the 29th largest cryptocurrency by market capitalization in September 2022.

(Live Coin Watch, CoinMarketCap)

Even though it was created as a result of a hard fork of BTC, BCH hasn’t managed to reach the same level of popularity as BTC. Cryptocurrency market statistics show that it lost much of its value. It had an all-time high price of $4,355, while in September 2022, the price was at around $120.

27. There are more than 40 different types of cryptocurrencies.

(Live Coin Watch)

A number of cryptocurrencies have different use cases than Bitcoin. Some of the most notable categories are privacy coins, smart contract platforms, exchange tokens, and storage tokens.

Crypto Stats and Demographics

Who are crypto investors? Who is likely to trade cryptocurrency, and who is more likely to save digital assets for long-term profits? Despite the global crisis, numbers of cryptocurrency users are growing worldwide, and more and more businesses are accepting cryptocurrency in addition to fiat currency.

28. Vietnam has more than 20% of the population owning cryptocurrencies.

(TripleA)

With more than 20 million crypto owners, it’s among the top five countries participating in the global blockchain market.

29. More than 46 million Americans are cryptocurrency owners.

(TripleA)

They make up 13.7% of the country’s total population and 22% of its adult population. While it’s not the highest population percentage, according to the global cryptocurrency ownership data, the US is leading in terms of the sheer number of investors.

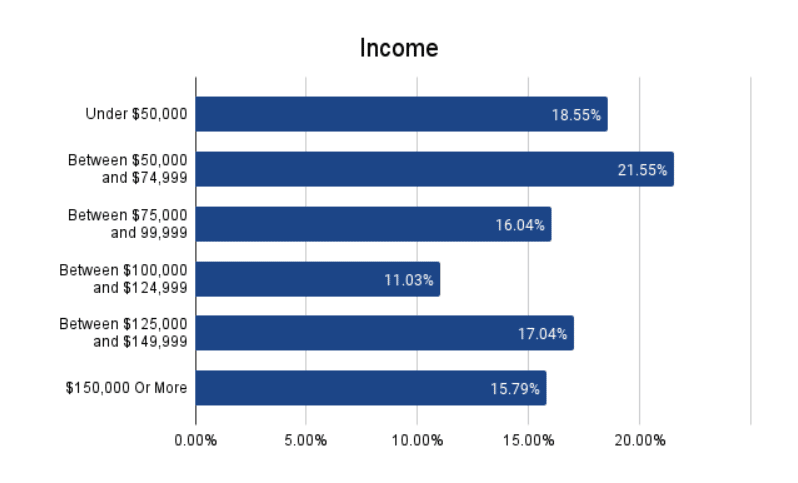

30. Nearly 44% of crypto owners in the US have an annual income of $100,000 or more.

(TripleA)

Understandably, Americans with higher incomes have more disposable capital they can use to invest in cryptocurrencies.

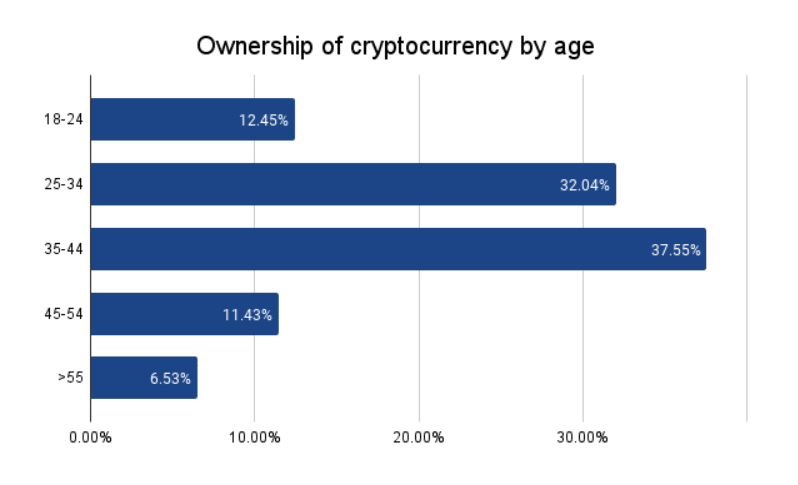

31. 82% of investors in cryptocurrency are in the 18-44 age group.

(TripleA)

Only 6.53% of investors are older than 55. The largest age group is Americans between 35 and 44 (37.55%), followed by those aged between 25 and 34 (32.04%).

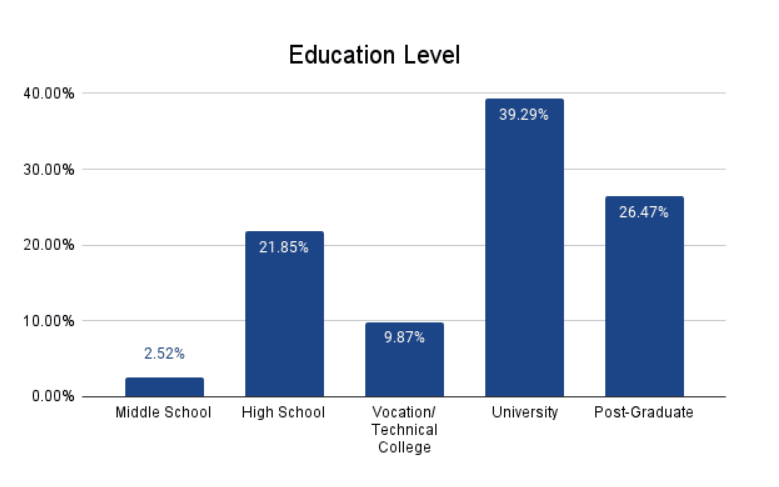

32. Nearly 66% of crypto owners have a university or postgraduate education.

(TripleA)

Crypto investment is usually undertaken by highly educated people. When talking about cryptocurrency users, statistics say that 26.47% of them are post-graduates, while 39.29% have at least a bachelor’s degree.

33. 81% of adults in the US have at least heard about cryptocurrencies.

(TripleA)

The awareness of cryptocurrencies has increased significantly, from 69.2% in 2020.

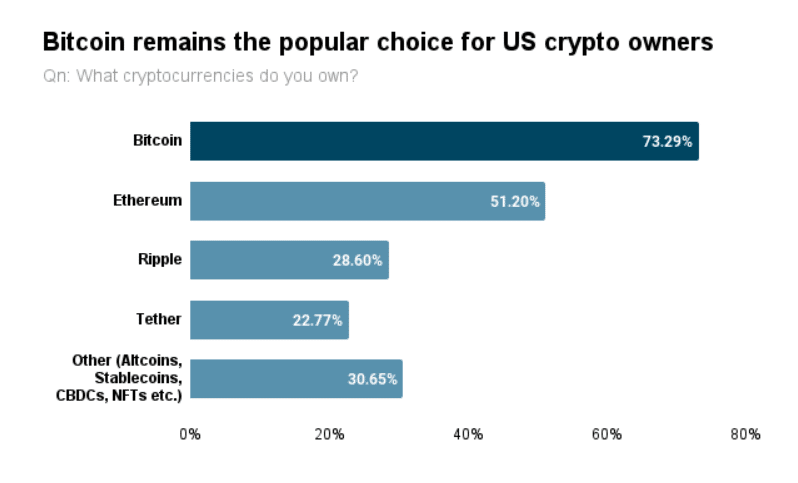

34. Bitcoin is the digital asset of choice for 73.3% of US crypto owners.

(TripleA)

The high number of Bitcoin owners is not surprising, as this is the first digital currency that started the industry and has repeatedly proved itself. With 51.2%, Ether is second among the most valued digital assets.

35. In 2022, 46% of Americans say their investment in crypto has been worse than they expected.

(Pew Research Center)

Only 15% of people invested in crypto in the US feel they fared better than expected despite the recession and inflation, while 31% say it worked out for them as expected.

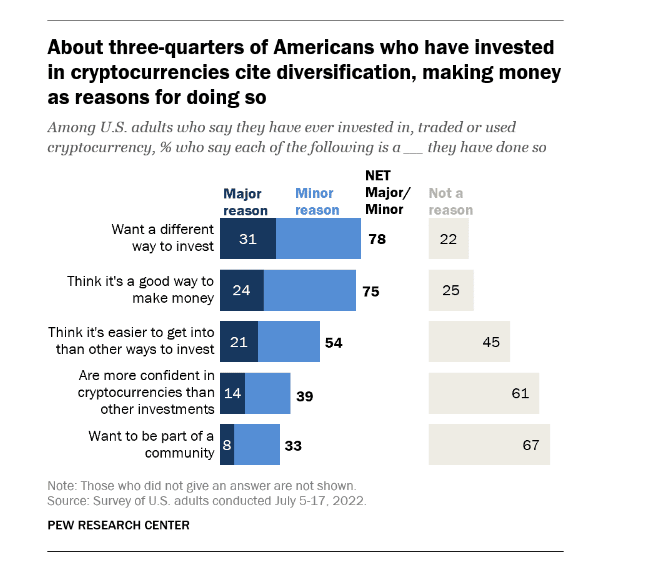

36. 78% of US investors see their crypto investments as a way of diversifying their portfolio.

(Pew Research Center)

Cryptocurrency growth statistics are why almost three-quarters of them think virtual currency is the way to make more money.

37. The number of investors in the US looking at crypto as an investment only dropped to 40.4% in 2021.

(TripleA)

In 2020, more people saw cryptocurrencies as a way of investing rather than a currency they can use to purchase goods and services. Corporations such as Starbucks, PayPal, Microsoft, and Amazon have adopted some form of crypto payments.

Meanwhile, many corporations like Tesla, Walmart, Samsung, and BlackRock are investing in blockchain and buying cryptocurrencies.

38. Cryptocurrency payments are eagerly expected by users across all industries.

(TripleA)

In particular, users would prefer to pay with crypto for their entertainment (53.6%) and eCommerce transactions (52.9%).

39. Globally, 63% of cryptocurrency investments are made by men.

(TripleA)

Only 37% of investors are women, a significant improvement compared to previous years when even fewer participated in the crypto and blockchain space.

40. In the US, 42% of men aged between 18 and 29 have used cryptocurrencies.

(Pew Research Center)

Only 17% of women in that same age bracket have bought, received, traded, or paid with crypto. When it comes to gender, cryptocurrency demographics lean more toward the male population.

41. Hispanic (22%) and Asian American (22%) communities are most interested in investing in cryptocurrencies.

(Pew Research Center)

Black (20%) and white (13%) communities in the US are falling a bit behind with crypto adoption and investing.

42. Almost 68% of US-based crypto investors hold more than $1,000 in these digital currencies each.

(TripleA)

Furthermore, almost one-third of investors hold between $5,000 and $10,000 in cryptocurrencies each, while more than 15.9% have more than $10,000 each.

Cryptocurrency Adoption Statistics

Lack of knowledge and information are the biggest hurdles to broader crypto adoption. However, over the last few years, especially during the 2021 bull market, an increased number of investors have been interested in crypto.

43. In 2021, the global adoption rate of cryptocurrencies increased by 880%.

(Chainalysis)

Vietnam is a leading country in the adoption of cryptocurrencies, with the most individual active users per capita. However, the US is leading in the implementation of decentralized finances, along with Vietnam, the UK, and Thailand.

44. El Salvador is the first country to accept Bitcoin as a legal tender.

(Reuters)

On June 9, 2021, El Salvador officially became the first country to use BTC along with USD as legal tender. The government’s goal was to make it easier for Salvadorans living abroad to send money to their families back home.

45. 55% of US investors are interested in increasing their crypto holdings throughout 2022.

(TripleA)

How many people own cryptocurrency and view it as a potential investment has significantly changed over the years, especially in 2021. It remains to be seen if the 2022 market crash has changed people’s attitudes.

46. Lack of knowledge was the most significant deterrent to 64% of investors.

(TripleA)

Appropriate education and raising awareness of digital currencies can significantly increase further steps in widespread adoption. For 29.5% of the interviewed US residents, the issue is the non-acceptance of cryptocurrencies by merchants and shops.

Almost 75% of those that already own crypto agree that businesses can improve their revenue if only they started accepting cryptocurrencies as a payment method.

Cryptocurrency Stats – Gambling

The online gambling industry has seen great benefits from being one of the first sectors to adopt Bitcoin and, later on, cryptocurrency technology in general.

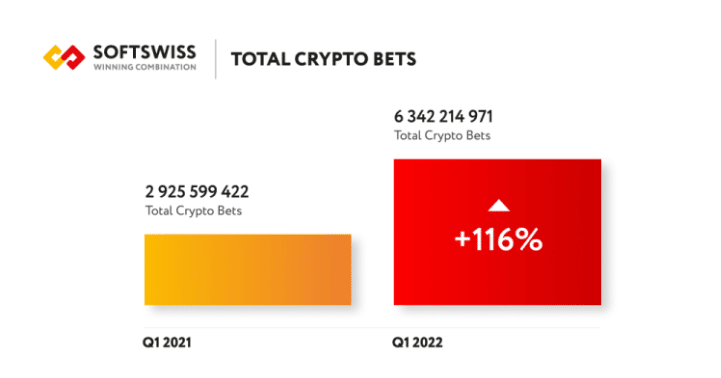

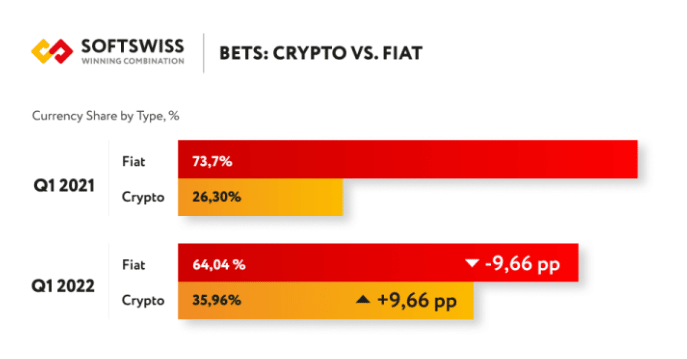

47. In Q1 2022, crypto betting grew by 116% compared to Q1 2021.

(SOFTSWISS)

Crypto betting sites have grown into a separate industry with their own products, sites, and services. This significant increase in growth is attributed to the COVID-19 pandemic that urged people to stay home and look for online alternatives for their entertainment needs. The trend continued into 2022.

48. Cryptocurrency betting has seen an increase of 9.66 percentage points in 2022.

(SOFTSWISS)

While betting with fiat currency still makes up 64.04%, crypto has seen an impressive rise to 35.96%.

49. Bitcoin remains the most popular cryptocurrency for gamblers.

(SOFTSWISS)

Bitcoin still dominates cryptocurrency transaction statistics, with 72.8% of bets. However, Ether (13.45%) and Litecoin (6.45%) transactions saw increases in their shares of 3.45 percentage points and 2.95 percentage points year-on-year, respectively, in Q1 2022.

Conclusion

So, how many people are invested in crypto? The answer to this question is not as simple as it may seem.

According to the available data, the number of individual cryptocurrency investors has increased significantly over the last few years. Still, it needs more time to grow. It’s currently relatively small when compared to some other asset classes. Lack of awareness and understanding are the primary barriers to broader adoption.

Global cryptocurrency adoption data shows that the sector has been growing steadily, with more businesses and individuals using digital assets for various purposes. The industry is still in its early stages, and it will be interesting to see how it develops over the next few years.

What do you think about the future of cryptocurrencies? Will the size of the crypto market shrink further due to inflation, the looming recession, and the economic crisis? Or will it be a perfect opportunity to jump in for those who want to buy crypto at a discount?

FAQ

What is so interesting about cryptocurrency?

Crypto is interesting because it’s a new asset class with tremendous growth potential in recent years, as cryptocurrency growth statistics show. Many people are interested in investing in cryptocurrencies because they believe the price of these assets will continue to go up over time.

Furthermore, projects like Ethereum, Monero, and Cardano have shown a lot of potential for innovation in the space. Finally, the fact that cryptocurrencies are decentralized and not controlled by any one government or organization makes them appealing to many people who are critical of traditional financial institutions.

How does cryptocurrency turn into money?

Cryptocurrency can be turned into money (fiat currency) by selling it on a cryptocurrency exchange. Cryptocurrency exchanges are online platforms where you can buy and sell cryptocurrencies. You’ll need to register with an exchange and create an account before you can buy or sell any cryptocurrencies, which will include providing some sort of personal identification.

Once you have an account, you can deposit money (fiat currency) into it, which you can then use to buy cryptocurrencies. You can also withdraw your cryptocurrency holdings back into fiat currency, which you can then send to your bank account.

What are the basics of cryptocurrency?

Cryptocurrency is a digital or virtual asset that uses cryptography to secure transactions and control the creation of new units. Cryptocurrencies are decentralized, a feature that keeps them outside of government control. Bitcoin, the first cryptocurrency, was created in 2009.

Cryptocurrencies are typically traded on decentralized exchanges and can be used to pay for goods and services. They can also offer anonymity, which has made them popular with people concerned with their privacy.

What are the pros and cons of cryptocurrency?

Crypto stats show a lot of positive sentiment towards cryptocurrencies as they offer many advantages, including anonymity, decentralization, fast and cheap transactions, and security. However, they also have a number of disadvantages, including their volatility, lack of regulation, and susceptibility to hacking and fraud.

Social engineering is also a risk, as people have been tricked into sending money to scammers posing as legitimate cryptocurrency exchanges or wallets. Ultimately, whether or not cryptocurrencies are a good investment depends on your individual circumstances and risk tolerance.